Media

Ivanhoe Mines announces outstanding economic results of the independent Integrated Development Plan (IDP) for the tier one Kamoa-Kakula Copper Project

Ivanhoe Mines’ Co-Chairs Yufeng “Miles” Sun and Robert Friedland announced today that the company and its partners, Zijin Mining Group, Crystal River Global Limited and the government of the Democratic Republic of Congo (DRC), welcome the extremely positive findings of an independent definitive feasibility study (DFS) for the development of the Kakula Copper Mine; together with an updated prefeasibility study (PFS) that includes ore mined from the nearby Kansoko Copper Mine in addition to ore mined from Kakula; and an updated, expanded preliminary economic assessment (PEA) for the overall development plan of all the copper discoveries made to date at the Kamoa-Kakula Project on the Central African Copperbelt in the DRC.

Definitive feasibility study for stage one Kakula Mine development. The Kakula 2020 DFS evaluates the development of a stage one, 6-Mtpa underground mine and surface processing complex at the Kakula Deposit with a capacity of 7.6 Mtpa, built in two modules of 3.8 Mtpa, with the first already under advanced construction. Remaining initial capital cost of US$0.65 billion for this option would result in an after-tax net present value at an 8% discount rate (NPV8%) of US$5.5 billion. The internal rate of return of 77.0% and project payback period of 2.3 years confirm the compelling economics for the Kamoa-Kakula Project’s stage one of production.

Pre-feasibility study including Kansoko Mine development. The Kakula-Kansoko 2020 PFS evaluates the development of mining activities at the Kansoko Deposit in addition to the Kakula Mine, initially at a rate of 1.6 Mtpa to fill the concentrator at Kakula, eventually ramping up to 6 Mtpa as the reserves at Kakula are depleted. Remaining initial capital cost of US$0.69 billion for this option would result in an after-tax net present value at an 8% discount rate (NPV8%) of US$6.6 billion. The internal rate of return of 69.0% and project payback period of 2.5 years confirm the compelling economics of Kakula and Kansoko.

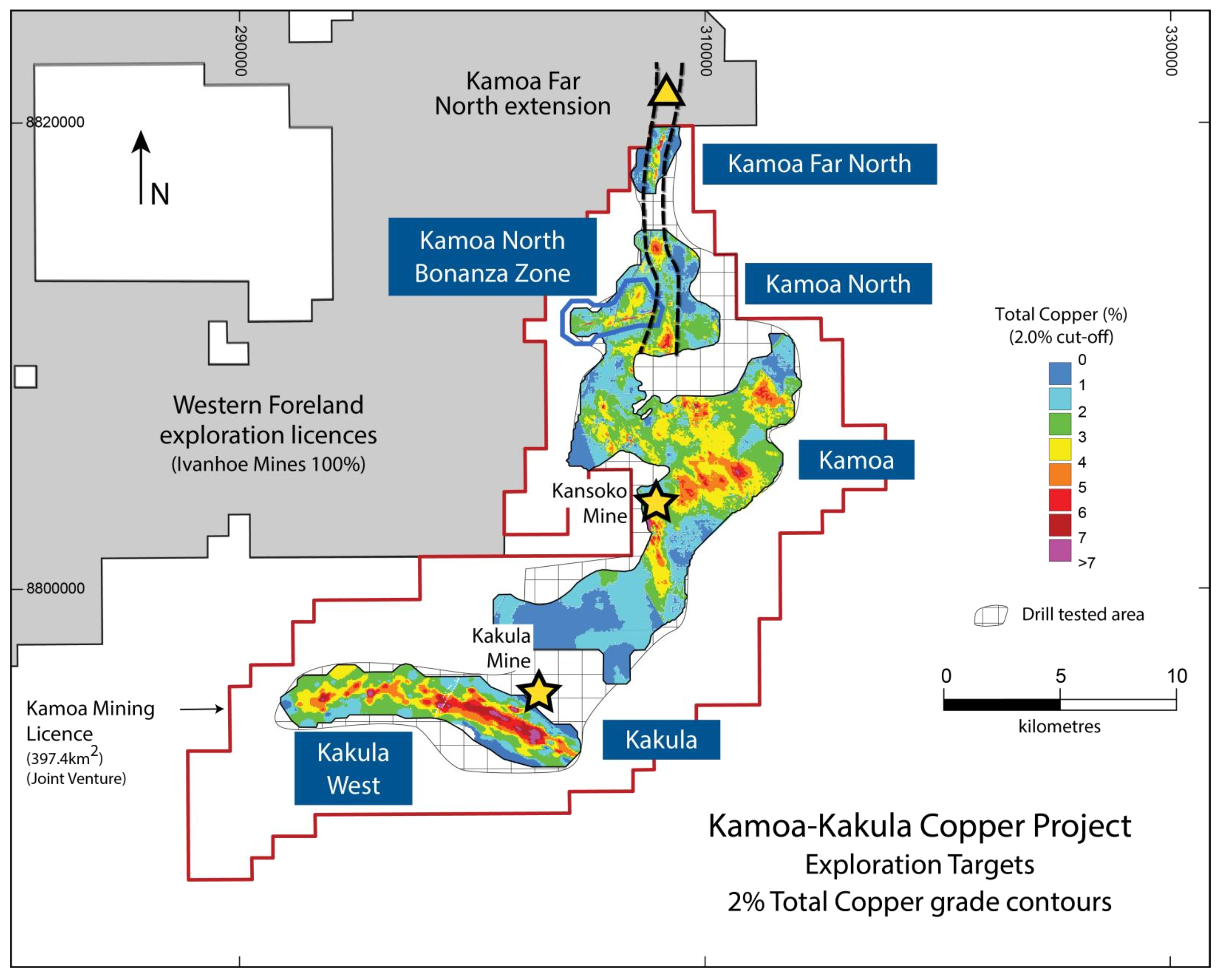

The Kamoa-Kakula 2020 PEA includes an analysis of the potential for an integrated, 19-Mtpa, multistage development, beginning with initial production from the Kakula Mine, to be followed by subsequent, separate underground mining operations at the nearby Kansoko, Kakula West and Kamoa North mines, along with the construction of a direct-to-blister smelter. The Kamoa North Area comprises five separate mines that would be developed as resources are mined out elsewhere, to maintain the production rate at up to 19 Mtpa, with an overall life in excess of 40 years. The 19-Mtpa scenario shows the potential for average annual production of 501,000 tonnes of copper at a total cash cost of US$1.07/lb. copper during the first 10 years of operations and production of 805,000 tonnes of copper by year 8. At this future production rate, Kamoa-Kakula would rank as the world’s second largest copper mine.

Map of the Kamoa-Kakula mining licence showing the Kakula and Kansoko mining areas, as well as Kakula West, Kamoa North, Kamoa Far North, Kamoa North Bonanza Zone and a portion of Ivanhoe’s adjacent, 100%-owned Western Foreland exploration-licences area.

RECENT NEWS

·

·